Survey Reveals Confusion Around IFTI Reporting

Complete and accurate reporting to regulators is a challenge for many financial institutions, with changing legislation, technological innovation and new payment standards adding complexity to the puzzle. International Fund Transfer Instructions (IFTIs) are perhaps the most complicated reportable transaction to understand for AUSTRAC-regulated entities, as different jurisdictions and ambiguity in the rules make it hard to know what to report.

IFTI misinterpretation is a persistent issue

Misinterpretation of regulatory requirements is a known problem the industry has faced for many years.

Regulation Asia drew attention to the issue in 2019, stating that IFTIs were “causing headaches for banks and NBFIs (non-bank financial institutions).” The ramifications of not having a robust IFTI reporting framework in place has resulted in severe financial and reputational impacts.

In 2021 Ashurst stated that they recognised it as a problem for their clients, too, identifying “over-reporting, under-reporting and misreporting their cross-border payments. In some cases, certain payment message types had been misused and payment data had been identified in incorrect fields. The improper classification of payment messages and the presence of data quality issues reduce payment transparency and make adherence to IFTI reporting obligations more difficult to achieve.”

Nathan Lynch, Author of the Lucky Laundery commented on AUSTRACs investigation into Perth Mint, saying “It’s another case study in the perils of Australia’s IFTI reporting regime, which has confounded the likes of Westpac, AfterPay and PayPal.”

Our research reveals extent of the IFTI issue

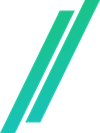

BNDRY conducted a short research survey to examine industry sentiment around IFTI reporting to understand the problem more deeply.

The survey questioned 166 participants from compliance and risk departments across Australia to understand the level of confusion in interpreting IFTI reporting rules.

Various scenarios were presented to participants for them to assess whether the transactions were reportable as IFTIs to AUSTRAC or not.

Whilst participants were familiar with IFTI, TTRs and SMR transactions and the processes involved, research results demonstrated that there is still plenty of confusion around what should and shouldn’t be reported.

Of the eight scenarios presented, only three had a clear consensus on reporting with majority of the scenarios receiving split results, highlighting the ambiguity.

Examples of some of the scenarios are presented below.

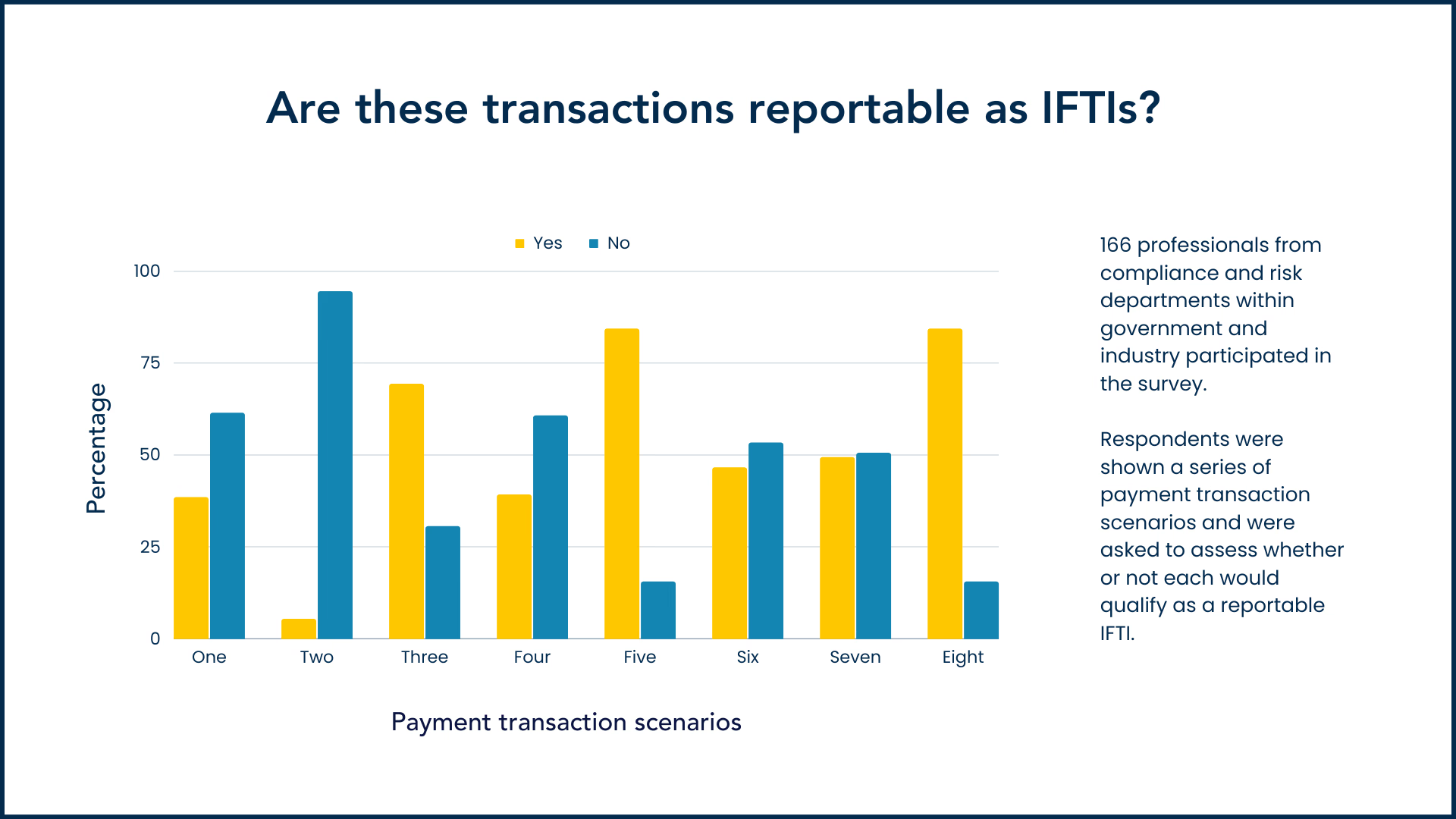

In the first payment flow (fig. 2) the funds are travelling between two international countries, US and the UK. In the first question, 69% of respondents determined that the transaction would be reportable, while 31% believed it would not. For the second question, 39% of participants answered that the transaction was reportable as an IFTI, while 61% said it would not be.

While the scenario may appear straightforward, the survey results are mixed, highlighting the challenge for many professionals in understanding what is and is not reportable, even for somewhat simple transactions.

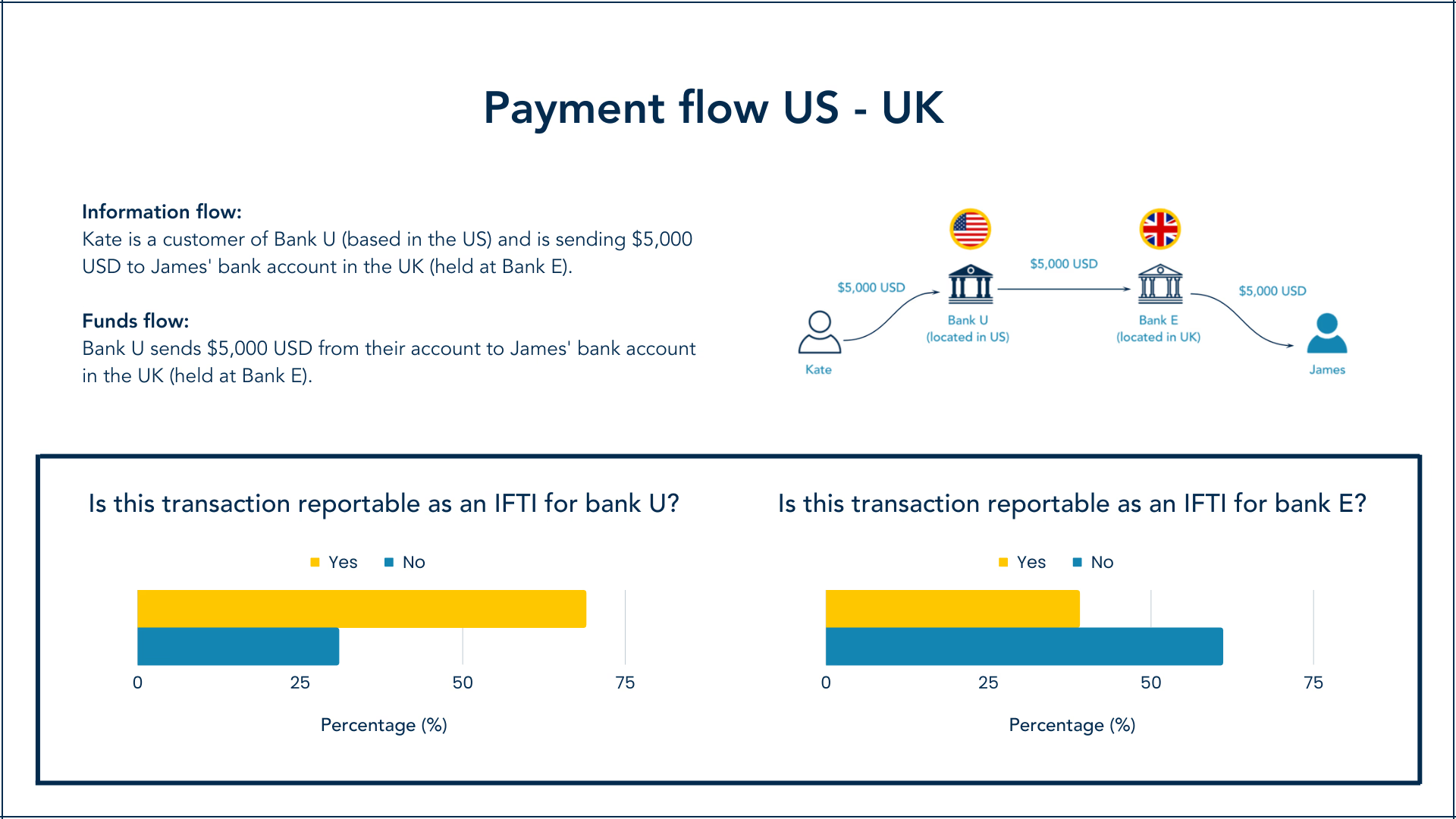

In this example (fig. 3), the payment is moving between banks in Australia before ultimately reaching the final destination in the United States. With the introduction of a second party in Australia, participants were divided over whether the transaction would have to be reported by the first bank (A), since the payment was moving through a domestic rail.

As the results showed, some of the group believed that the transaction would be reportable as an IFTI, while others did not (presumably due to the payment travelling domestically and not across borders). The answers were split down the middle, with 47% of the group saying yes, while 53% determined not.

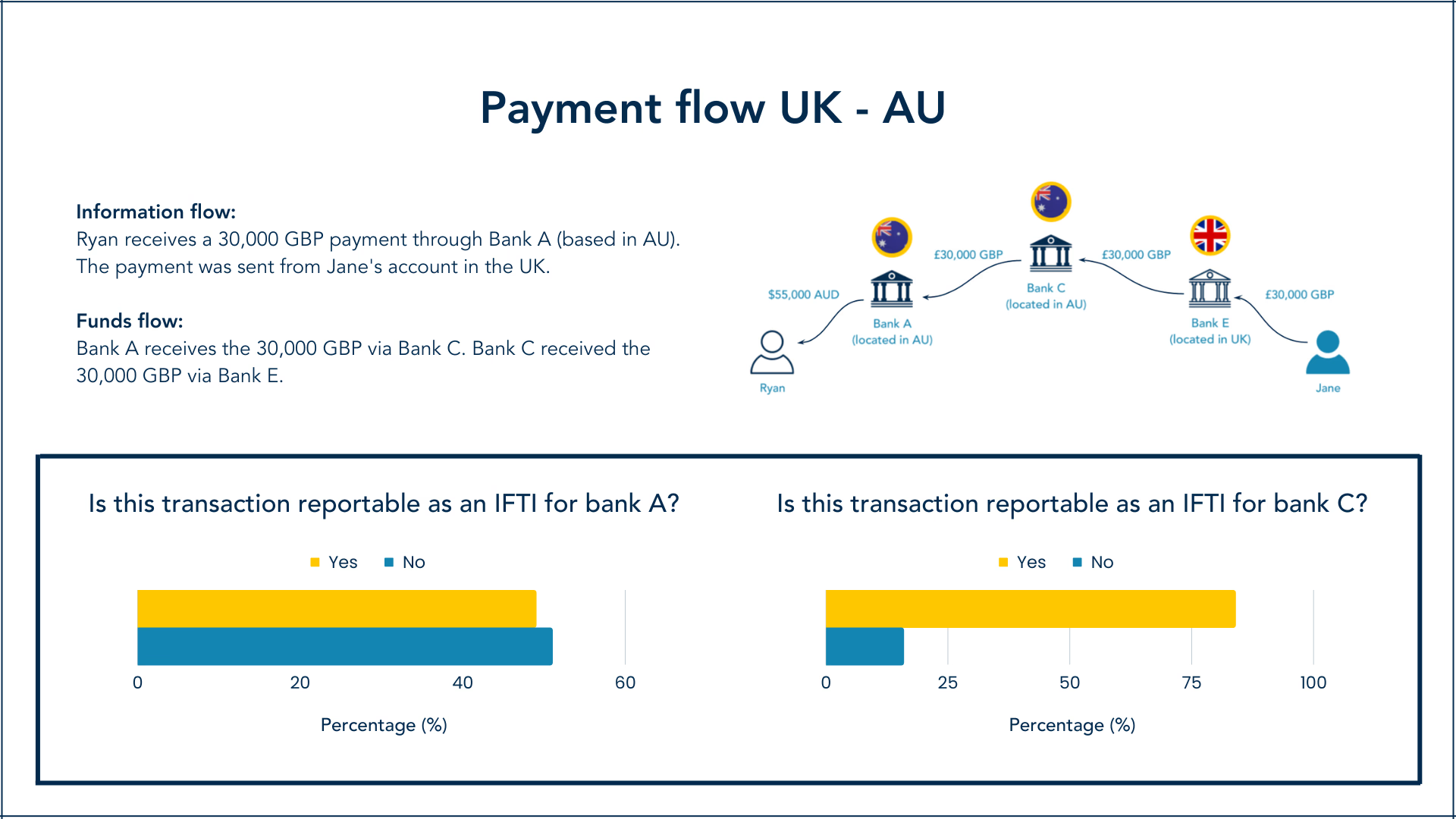

In this example (fig. 4) the payment is moving from an overseas account in the UK to an intermediary bank in Australia, before finally arriving to the end user. Again, results here were mixed, mirroring those of the previous example.

With the first question, 49% of participants agreed that Bank A would have to report the transaction as an IFTI, while 51% believed the bank did not. This further cements the idea that entities are confused about what counts as an IFTI, particularly when it comes to payments that travel through multiple parties.

How AUSTRAC and entities are improving IFTI reporting

Following industry consultations, AUSTRAC recognised the need to assess their rules and is expected to release new guidance on AML/CTF reporting. The updated guidelines aim to clarify reporting requirements and help financial institutions better comply with regulations.

Whilst the regulator’s new IFTI rules are set to alleviate some of the reporting burden, real benefits will only be available to entities that actively participate in improving their processes. Commenting on the importance of collaboration Nicole Rose, former CEO of AUSTRAC, said, “every business with obligations under the AML/CTF Act must have robust systems in place to ensure they meet their requirements and play their part in protecting Australia’s financial system from criminal exploitation.”

The challenges associated with IFTI reporting are real and complex. Financial institutions need to ensure they have the necessary infrastructure and processes in place to accurately report on their regulatory compliance obligations.

Many entities are looking toward third-party technology providers rather than their own in-house builds to support their regulatory reporting requirements. BNDRY helps financial institutions ensure complete and accurate IFTI and TTR reporting to AUSTRAC. The platform provides assurance that reporting has been done right, automates manual processes and offers full auditability and oversight of transactions.

Learn more about how BNDRY can help you improve your AUSTRAC reporting here.