Onboard, Verify and Monitor. All in BNDRY.

Customer due diligence starts with onboarding. And now, so does BNDRY.

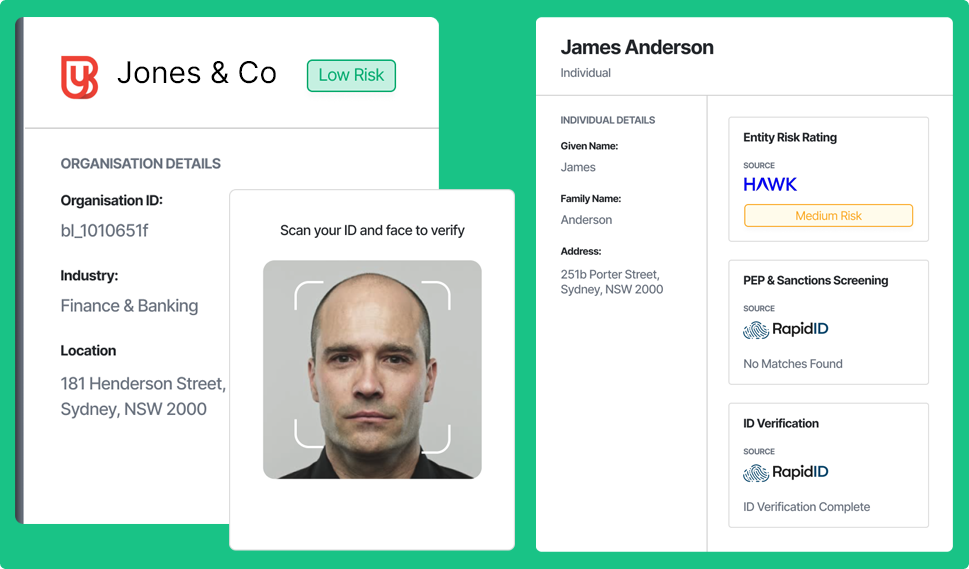

We launched BNDRY's Risk Hub earlier this year to give compliance teams one central place to store customer data, assess risk and track due diligence activity. But we know that risk doesn’t start with monitoring, it starts with who you let through the door.

AML/CTF-regulated businesses are required to verify the identity of prospective customers before doing business with them. That means confirming identity against government sources, screening for PEPs and sanctions and making sure the person is who they say they are. On top of that, many businesses need to collect their own onboarding data through forms specific to their product or service.

Stitching all of this together into a smooth, end-to-end experience is tough. Most onboarding tools aren't built with end-to-end compliance in mind. And most compliance tools aren’t flexible enough to tailor onboarding. The result? A fragmented experience for customers and even more fragmented systems for compliance teams.

That’s why we’ve brought onboarding and KYC into BNDRY.

Now live: a complete onboarding and KYC flow, built into the platform.

Build custom sign-up and onboarding flows, automate checks, store everything in one place. No more scattered tools, just one clean pipeline from first interaction to ongoing due diligence.

Whether you're onboarding individuals or entities, BNDRY handles it all:

- Identity verification against government sources

- Optical Character Recognition (OCR) to reduce manual data entry

- Document verification against the Document Verification Service (DVS) database to confirm authenticity

- Biometric checks for liveness and facial matching

- Politically Exposed Persons (PEPs) and Sanctions screening

- Ongoing and enhanced due diligence

- Full audit trail

Run AML checks any time as part of your ongoing or enhanced due diligence process.

Got your own forms? Bring them. Got existing channels? Use our APIs to plug in and embed onboarding journeys into your existing experiences. Need to verify someone down the track? Do it in seconds, right from the entity record.

Plus, we’re adding support for ConnectID, a trusted identity verification method that lets your customers use credentials they've already verified with their bank. It's fast, secure, and preserves privacy.

BNDRY is the one platform you need for every step of the compliance journey.

With BNDRY, compliance teams finally get a connected view of every customer across onboarding, risk rating, ongoing monitoring and reporting.