Automate Your Customer Risk Ratings

Risk ratings are the backbone of any Anti-Money Laundering / Counter-Terrorism Financing (AML/CTF) compliance program. But managing them? That’s where things can get messy. Some teams are all-in on spreadsheets. Others are embracing automation. Most are somewhere in between.

We’ve compiled the three ways compliance teams are managing their customers’ risk today, and built BNDRY to make each one easier.

1. Fully manual, fully managed

For some compliance teams, managing customer risk is a hands-on job. Risk ratings are assigned manually at onboarding and reviewed periodically. This can be useful when decisions rely on subjective insights like unusual customer behaviour that doesn’t quite trigger a rule, but still raises a red flag.

For organisations across all AML/CTF regulated sectors, including real estate, gaming and financial services, the question where customer risk rating records are stored, is always an open one. Risk data often lives in spreadsheets to keep this sensitive data separate from broader business systems. But that brings its own set of problems: version control, limited access and no real audit trail.

BNDRY gives teams a better way. You can assign and update risk ratings manually, store explanations for every decision, and keep it all secure and auditable in one place.

2. Fully automated, integrated with your tools

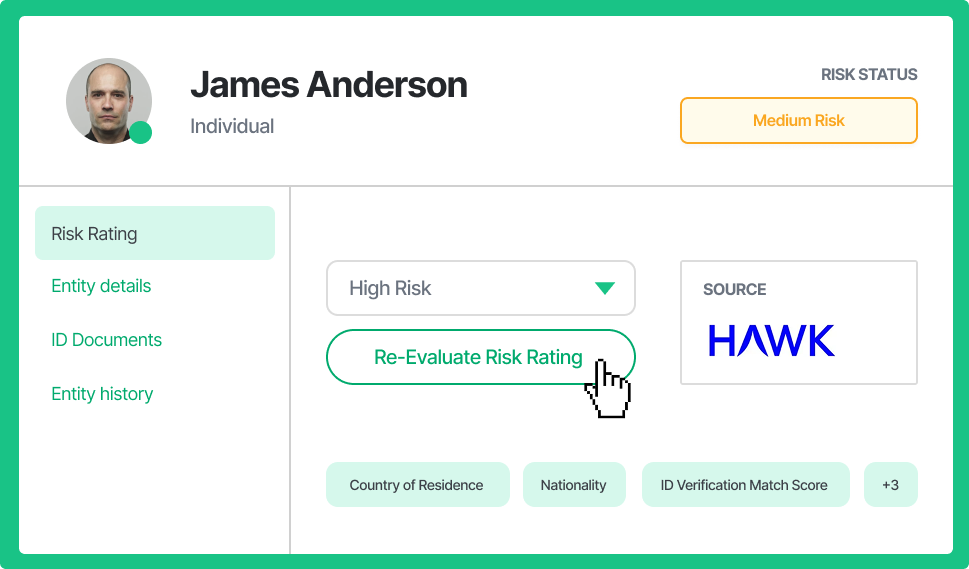

Want to set and forget? BNDRY integrates with providers like Hawk to automate customer risk ratings using your organisation’s rules. Set up logic once and BNDRY will calculate a risk score every time new data comes in during onboarding or when something material changes. You can set up automated risk rating calculations across a wide range of risk factors including geography, industry, screening and verification results, customer behaviour and more.

Once a risk rating calculation has been made, BNDRY shows you all of the risk factors that were flagged in the automation. This model means faster decisions, real-time updates and consistent outcomes aligned with your risk appetite.

3. A hybrid approach, on auto-pilot with human override

Most teams need a bit of both. With BNDRY, you can automate the bulk of your risk ratings, while giving your compliance team the power to override or update ratings manually when they need to. Whether it’s a red flag raised during a customer interaction or a risk insight that doesn’t follow the rules, your team stays in control.

Each rating, whether automated or manual, includes a timestamp and optional explanation, so you’ve always got a clear audit trail.

Whatever your model, BNDRY helps you simplify customer risk.

Manual, automated or hybrid, BNDRY is built to flex with your team’s approach. No more spreadsheet chaos, just structured, auditable, secure risk ratings that work for your business.